Bezos and Crypto: Changing the Data Business Model (Part 1)

Bezos and Crypto: Changing the Data Business Model (Part 3)

Last week, we shared some of our thoughts around Jeff Bezos’ insight into the early advantages of the internet and how those principles apply to cryptocurrencies and data business models.

This week, we pick up on another key principle Bezos’ discusses about the decision to start Amazon: growth. The growth we are talking about here isn’t at a company level, i.e. total customers, revenue, click-throughs, and so forth. Rather, its a more global, macro perspective that looks at how big a new technology might become.

In 1994, when Jeff Bezos was considering starting a company that would sell books over the internet, he wasn’t preoccupied with how many people currently buy books online (the answer would have been zero). He may have had a notional idea of how big the market for online book sales could be, but the more fundamental data point that intrigued him was the internet and it’s potential. And specifically, the growth rate of the internet — which he approximates was roughly 2300% annually in 1994 (was around 16 million people in 1995).

Here is Bezos in his own words:

While Bitcoin is certainly not the internet — since one is connecting to network of information and the other is a decentralized and distributed ledger — we think Bezos’ focus on core technology growth is a good one and useful in assessing new technology adoption. This also allows us to logically compare and contrast it to other technological advances such as the internet and its adoption.

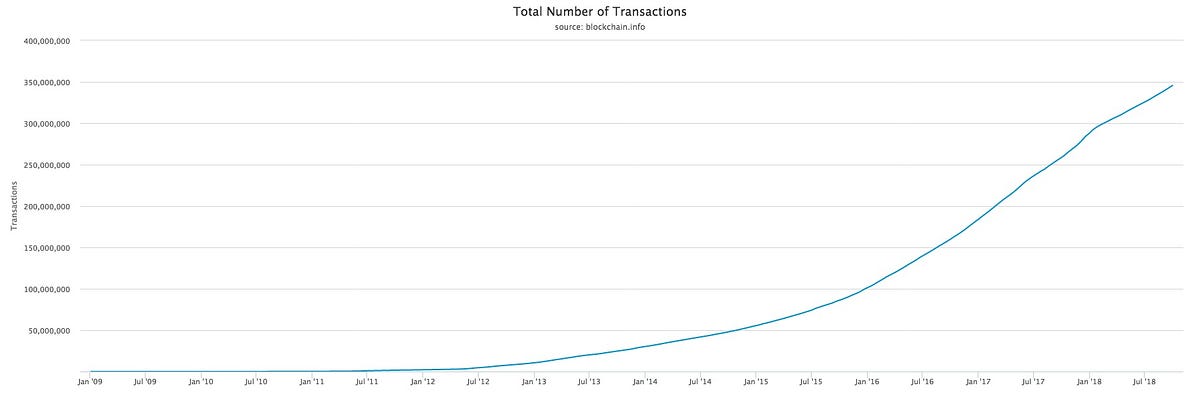

We could just show this chart of Bitcoin from its inception to current day with its elegant linear hockey stick growth and move on:

Total Number of Transactions (https://www.blockchain.com/charts)

But that isn’ really the full story of Bitcoin’s growth and likely wouldn’t pass Jeff Bezos’ muster. We need to drill down a bit more.

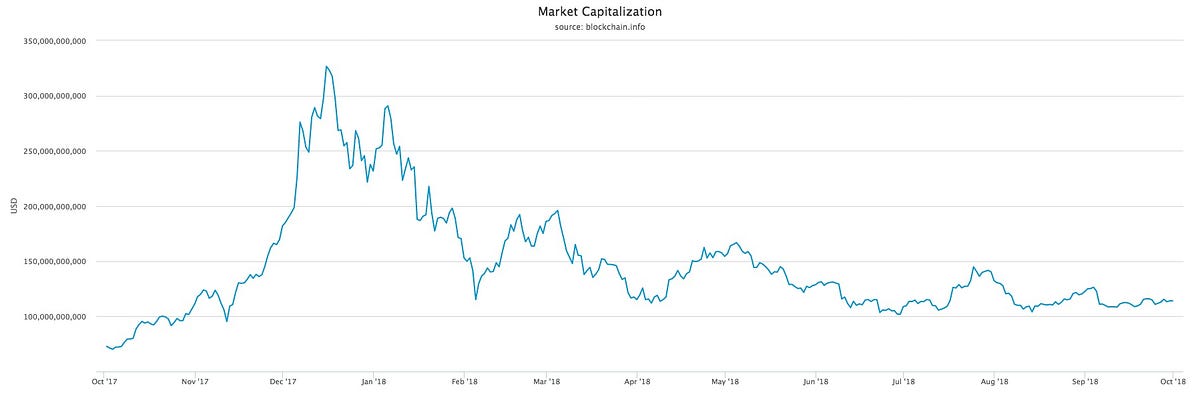

First, we look at market capitalization. When we look at Bitcoin growth in terms of market capitalization over the past year, we see roughly 57% annual growth:

1 Year Market Cap for BTC (https://www.blockchain.com/charts)

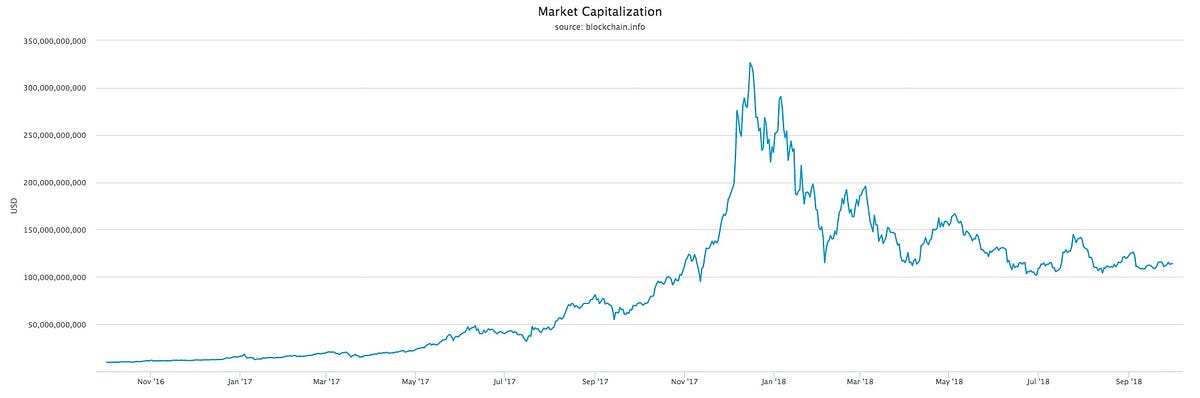

Good. But not 2300%. Of course, cryptocurrency is really just getting started in many respects. The story of Bitcoin and crypto goes back further than the past year of course. So looking at where the Bitcoin market cap is now from where it was two years ago, we see a more impressive 1077% growth rate:

2 Year Market Cap for BTC (https://www.blockchain.com/charts)

I think Jeff would approve of 1077% growth rate for any technology.

But, as mentioned previously, Bitcoin isn’t internet connections. It involves more technical effort and onboarding (at least currently). Two other cautionary factors: 1) it isn’t clear that crypto and Bitcoin specifically will follow the same growth trajectory as the internet nor that it needs to since its both a store of value as well as a means of commerce; and 2) as those in the cryptocurrency world know, Bitcoin transactions can be slow and expensive.

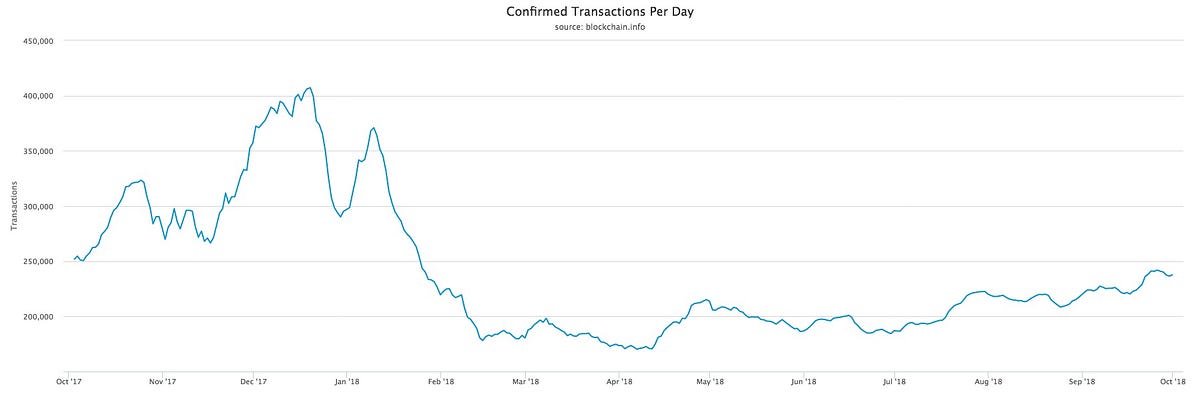

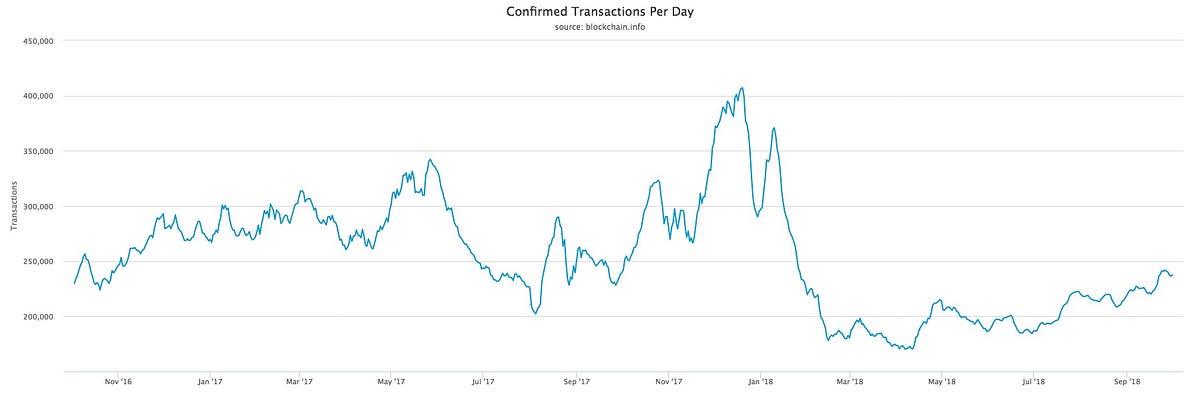

So lets look at Confirmed Transactions Per Day. Here we see year-over-year a decrease of -21%.

Confirmed transactions per day for 1 year (https://www.blockchain.com/charts)

But looking further back over the span of 2 years, we see roughly a 21% increase in confirmed transactions per day.

Confirmed Transactions per day for 2 years (https://www.blockchain.com/charts)

So what are we to think? Are Bitcoin transactions going up or are they going down? Or are they simply flat right now?

Bitcoin’s growth is undeniable in terms of increasing market capitalization. Growth in confirmed transactions has increased. But a “confirmed transaction” isn’t as simple as one entity confirming a transaction with another. Distributed, decentralized and private ledgers require more in terms of resources than what we think of today in terms of typical commercial transactions. Thats the upfront tradeoff for trustless privacy.

So if transactions are a core growth metric for cryptocurrency adoption, what is the current state? This is where the Lightning Network comes in and helps us understand what is happening right now in the growth and evolution of Bitcoin.

And a topic we will dig into in next week’s post as we continue to explore growth and Bitcoin/Lightning Network.

We would love to hear from you and get your thoughts. Feel free to connect with us on Twitter @Suredbits or join our Suredbits Slack community.