Introduction

On September 23rd, Bakkt, a subsidiary of the Intercontinental Exchange (ICE) (owners of the New York Stock Exchange), launched the much anticipated bitcoin futures contract. What makes the Bakkt offering unique is that it is the first contract to be settled in Bitcoin. Bakkt offers both daily and monthly futures contracts allowing investors to speculate on future prices movements and hedge portfolio risk.

Many in the crypto community believe the Bakkt offering is an important step in the courtship of institutional investment funds with the belief that it will bring greater participation and transparency. The Chicago Mercantile Exchange’s (CME) cash settled bitcoin futures contract has attracted more interest and money into bitcoin. The same optimism is held for Bakkt’s offering.

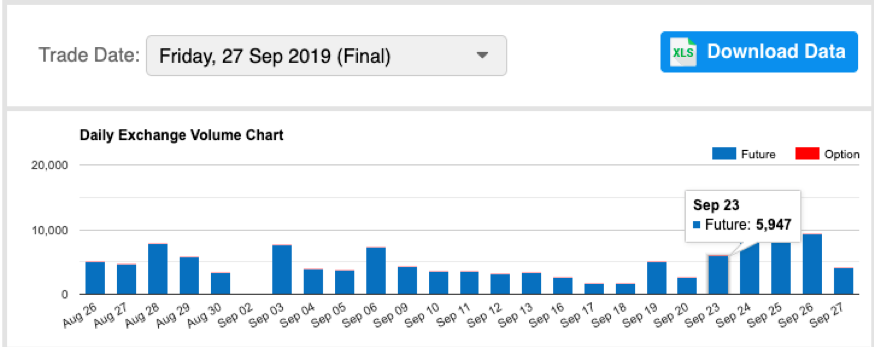

Though it is early, thus far the market responses to Bakkt’s futures and CME’s have been quite different. Whereas CME reported 5,947 open contracts (each contract representing 5 bitcoin) on the day of Bakkt’s launch:

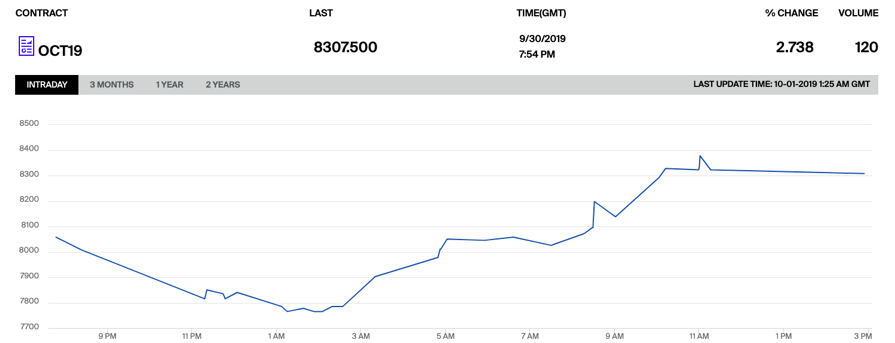

Bakkt’s volume is currently sitting at a total of 120 bitcoin representing approximately $996,840 in total volume based on current BTC prices.

A far cry from CME’s approximate $145,247,895 in trading volume for their October contract.

Analysis

There are a couple points worth considering regarding the Bakkt and their potential future.

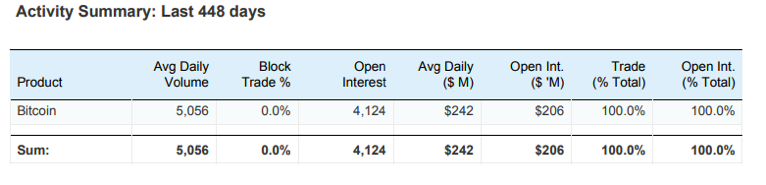

First, with an average daily volume of $242 million, CME’s futures contract represents the strongest sign to date of institutional and Wall St. investors interest and comfort with crypto.

Additionally, CME is set to launch bitcoin options trading in Q1 of 2020. This will give investors an additional instrument to use bitcoin as part of their investment portfolio. Bakkt, CME and planned offerings from others such as LedgerX, ErisX, etc. signal continued strong investor appetite in cryptocurrencies.

Second, by offering bitcoin settled futures, Bakkt has more competition from other companies. For example, BitMEX,, the popular crypto trading platform operating out of Hong Kong, has been in crypto futures industry since 2014 and was the first to offer a popular perpetual btc future contract. Bitmex averages roughly $3 billion in average bitcoin daily trading volume. Contrast that with Bakkt which just cleared $5 million this past week.

Aside from Bitmex, Kraken (U.K.) and Binance (Japan) are also in the bitcoin settled futures market and both have more experience and stronger footholds. Kraken has roughly $45.6 million in average daily bitcoin futures volume. Early reports on Binance invite-only Futures trading, though having only just launched in September 2019 (like Bakkt), show roughly $150 million in average daily trading volume.

Lastly, Bakkt is targeting the lucrative U.S. investor market. Getting approval in the U.S. is no easy task. It is time-consuming and expensive. Bitmex and others are not allowed to operate trading in the U.S. without prior review and approval from the SEC or CFTC. Alternatively, they can partner with a regulated U.S. entity. Gaining U.S. regulatory approval used to be the gold-standard. It remains a powerful signal to investors as U.S. markets are some of the most transparent and secure in the world.

However, we have seen exchanges – like Bitmex, Binance and Kraken – start outside of the United States achieve rapid adoption with global reach despite having little to no U.S. presence. Those firms, free of the time and expense of U.S. regulation, are now well-positioned with deep pockets and broad customer base, to enter U.S. markets on a much stronger foothold.

Conclusion

Settling a contract in bitcoin is a fundamentally different financial instrument than CME’s cash-settled bitcoin futures. As such, they may appeal to different types of investors. Over time, we may see those segments crossover into one another. However, Bakkt’s greatest competition may not be from traditional exchanges but rather from the new well-funded exchanges that are native to trading bitcoin futures.

Bakkt has only been operating for roughly a week. They are the first futures exchange in U.S. to settle in bitcoin. That alone is a significant, and we believe a positive development, for the growth and adoption of bitcoin. It is likely only a matter of time before the bitcoin native futures exchanges, either through partnership or acquisition, gain entry into the U.S. market. Ultimately, more financial instruments that bring greater exposure, liquidity and investment is a positive for the cryptocurrency markets.

Contact us @Suredbits

Contact Dan @GoDanSmith

All of our API services, for both Cryptocurrency APIs as well as Sports APIs, are built using Lightning technology and the Lightning Network. All API services are live on Bitcoin’s mainnet. Our fully customizable data service allows customers to stream as much or as little data as they wish and pay using bitcoin.

You can connect to our Lightning node at the url:

038bdb5538a4e415c42f8fb09750729752c1a1800d321f4bb056a9f582569fbf8e@ln.suredbits.com

To learn more about how our Lightning APIs work please visit our API documentation or checkout our Websocket Playground to start exploring fully customized data feeds.

If you are a company or cryptocurrency exchange interested in learning more about how Lightning can help grow your business, contact us at [email protected].