Last week we discussed how Lightning can help Exchanges create a better user experience by helping to create liquidity (link to post) for custom deposits and withdrawals. In that post, we mentioned the impact of on-chain fees. In this post, we explore Lightning’s impact to reduce expenses for crypto exchanges and their users by reducing on-chain fees. For additional background on this topic, see our previous post on Lightning Fees.

- Overview

- Regulation Part 1 — Money Transmitter Rules

- Regulation Part 2 — Money Transmitter Rules

- Security Part 1 — Overview

- Security Part 2 – Backing Up Your Lightning Wallet

- Security Part 3 – Private Key Management

- User Experience – Liquidity

- Managing Fees With Lightning

- Routing Nodes

- Conclusion

Background

A quick survey of some of the most significant cryptocurrency exchanges shows a range of fee schedules for customer deposits and withdrawals of bitcoin.

| Exchange | Deposit Fee | Withdrawal Fee |

| Binance | Free | .0005 BTC |

| Bitfinex | Free | 0.0004 BTC |

| Coinbase | Free | Free for Digital |

| Bitstamp | Free | Free for Digital |

| Gemini | Free | Free up to 10 times in a calendar month. .002 BTC if more than 10 in a month. |

| Kraken | Free | .0005 BTC |

| Bitmex | Free | Free |

* Exchanges currently supported on Suredbits API.

As we can see, depositing BTC is free across all exchanges. Withdrawal costs vary from free to .002 BTC.

“Free” deposits mean only that the exchange does not charge anything additional to deposit crypto into their platform. The user is responsible for paying on-chain deposit fees. As for withdrawals, “free” in this context means the exchange is covering the costs. As we see, many exchanges do charge a small amount to cover the on-chain fee.

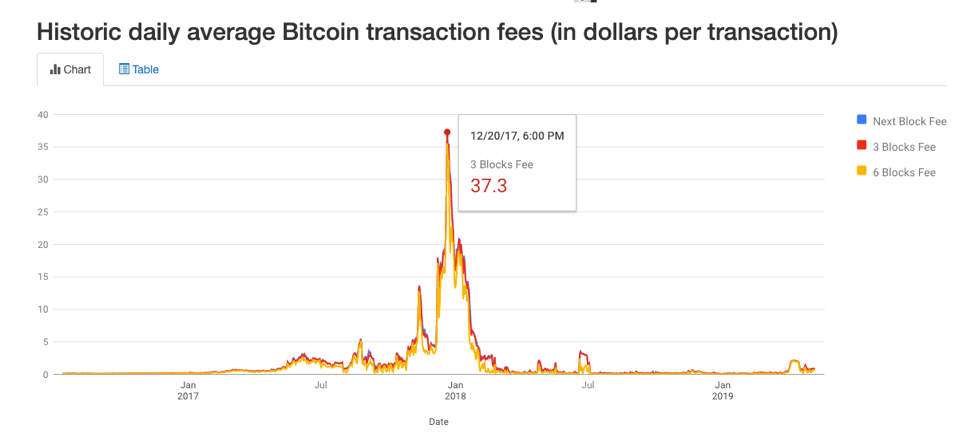

Covering the costs of deposits and withdrawals may not be significant in a time of low on-chain fees (as of this writing, it costs approximately $1.05). However, when fees start to increase to $4, $10, or the peaks of December 2017 when they hit $37, these transaction fees can severely impact an exchange’s operating cash flow and bottom line revenues.

The user’s trading strategy may no longer be profitable in a when fees are $10 per transaction. This means that they will not deposit this capital onto your platform and execute their strategy. Higher fees also disincentivize traders from depositing funds on to an exchange at all.

On-Chain Cost Drivers

Increasing on-chain fees: $1.00, $4.00, $12.50, etc. are clearly a problem. But what drives those fees is the core issue. Two critical elements that drive higher on-chain fees are volatility and growth in bitcoin usage.

Volatility in any process is difficult to manage. This is even more problematic when trying to exchange assets as it directly impacts the ROI. Exchanges that offer free withdrawals are eating that cost on their margins. If not managed well, cash can quickly start bleeding out on every withdrawal transaction. Given the inherent volatility of crypto markets, fees can spike very rapidly as people compete to have their transaction included in the next block.

By growth, we mean the total number of people using cryptocurrency and the total volume of transactions conducted on the blockchain. To be clear, growth is a good thing. It helps create markets, provide liquidity and is necessary for any business. But as the demand for bitcoin grows – both from consumers and institutional investors – it will only add to the congestion and competition of on-chain transactions. As more activity is pushed on-chain, the scarcer the resource of space in the block becomes and thus, fees will go up.

Lightning Solution

The solution to managing this variability and growth is the Lightning Network. Lighting doesn’t just offer significantly cheaper transaction fees at an incredibly faster rate, it does so reliably. That is the key. As we have written previously, Lightning has a fundamentally different architecture than a blockchain. The most scarce resource for a blockchain are the CPU, memory and bandwidth usage of each validating node on the network.

Lightning, however, relies on capital. This capital provides liquidity. Unlike bitcoin, the more people that adopt Lightning, the more liquidity in the network. Lighting leverages this network effect to resolve congestion and smooth out the variability of fees. Fees on Lighting Network are many orders of magnitude less than bitcoin on-chain fees. Thus, are far less disruptive as they change. And again, with Lightning, the more users on the network, the more we can expect competition to lower fees.

Summary

Fees on the bitcoin blockchain can quickly escalate. Higher fees create friction for both exchanges and traders. For exchanges, fees can erode their bottom line revenue. For traders, they can compromise trading strategies, reduce returns on investments and act as a disincentive to depositing funds. Fee volatility will only increase as more people use bitcoin.

Lightning solves this by leveraging the growth of bitcoin to create liquidity off the chain and enable faster, cheaper and reliable payments.

If you’re interested in chatting more about Lightning Network technology or crypto tech in general, you can find us on Twitter @Suredbits or join our Suredbits Slack community.

If you are an exchange or interested in what Lightning can do for you and your business, contact us at [email protected].

You can also reach us on the Lightning Network:

038bdb5538a4e415c42f8fb09750729752c1a1800d321f4bb056a9f582569fbf8e@ln.suredbits.com.